Local Storage seems to be disabled in your browser.

For the best experience on our site, be sure to turn on Local Storage in your browser.

The Best Stocks to Buy in the Market Today

- Best stocks to buy in the market today

- Best trade platforms to trade monitor

- The most important factors in the decision to sell and buy in the stock market

- How much does reading books help us succeed in the stock market?

Best stocks to buy in the market today

Invest in these companies for long-term growth and potential income

The stock market can be a volatile place, but it can also be a great way to build wealth over the long term. If you're looking for the best stocks to buy in the market today, you'll want to consider companies that are well-established, have a strong track record of growth, and are operating in industries that are expected to continue to grow in the future.

Apple (AAPL)

Apple is one of the most valuable companies in the world, and for good reason. The company has a dominant position in the smartphone market, and its other products, such as the iPad, Mac, and Apple Watch, are also very popular. Apple is also a leader in the development of new technologies, such as augmented reality and artificial intelligence.

Amazon (AMZN)

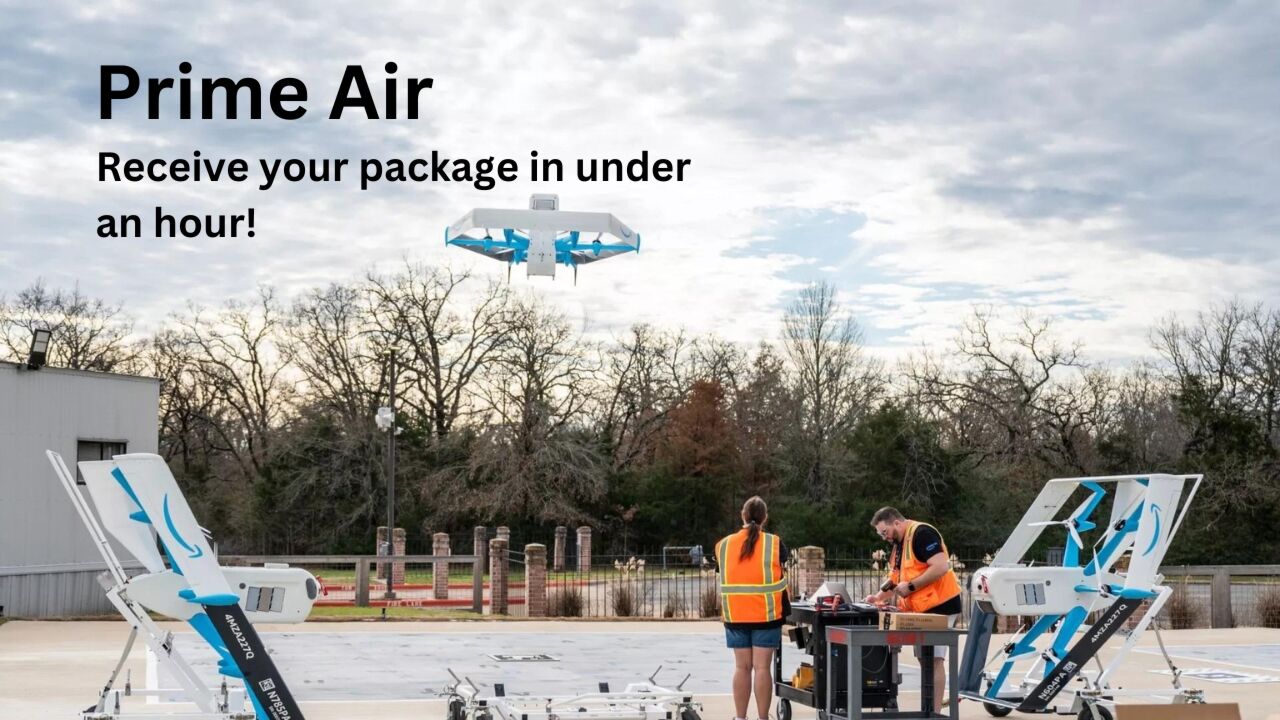

Amazon is the world's largest online retailer, and it's also a major player in cloud computing and other technology businesses. Amazon is constantly innovating and expanding, and it's well-positioned to continue to grow in the years to come.

Microsoft (MSFT)

Microsoft is a software giant with a wide range of products and services, including the Windows operating system, the Office suite of productivity applications, and the Azure cloud computing platform. Microsoft is also a leader in the development of artificial intelligence and other new technologies.

Alphabet (GOOGL)

Alphabet is the parent company of Google, the world's most popular search engine. Alphabet also owns other valuable businesses, such as YouTube and Android. Alphabet is a leader in the development of new technologies, such as artificial intelligence and self-driving cars.

Tesla (TSLA)

Tesla is the world's leading electric vehicle manufacturer. The company is also developing solar panels and battery storage systems. Tesla is well-positioned to benefit from the growing demand for electric vehicles and renewable energy.

These are just a few of the best stocks to buy in the market today. When choosing stocks to invest in, it's important to do your own research and consider your own investment goals and risk tolerance.

Best trade platforms to trade monitor

There are many different trade platforms available, but not all of them are created equal. When choosing a trade platform, it is important to consider your individual needs and preferences. Some of the most important factors to consider include real-time data, charting tools, technical indicators, order types, and customer support.

-

TradingView

TradingView is a popular trade platform that offers a wide range of features and tools, including real-time data, charting tools, technical indicators, and a variety of order types. TradingView also offers a free account with limited features, as well as paid accounts with more features and functionality.

-

Thinkorswim

Thinkorswim is a trade platform offered by TD Ameritrade. Thinkorswim offers a wide range of features and tools, including real-time data, charting tools, technical indicators, and a variety of order types. Thinkorswim is a good option for active traders who need a powerful trading platform.

-

NinjaTrader

NinjaTrader is a trading platform that offers a wide range of features and tools, including real-time data, charting tools, technical indicators, and a variety of order types. NinjaTrader is a good option for active traders who need a customizable trading platform.

-

Sierra Chart

Sierra Chart is a trade platform that offers a wide range of features and tools, including real-time data, charting tools, technical indicators, and a variety of order types. Sierra Chart is a good option for active traders who need a reliable and fast trading platform.

-

QuantConnect

QuantConnect is a backtesting and live trading platform that allows you to create and deploy trading algorithms. QuantConnect is a good option for traders who want to automate their trading.

Ultimately, the best trade platform for you will depend on your individual needs and preferences. I recommend that you try out a few different platforms to see which one you like best.

Most important factors in the decision to sell and buy in the stock market

Have you ever wondered what factors play a crucial role in selling or buying stocks in the market? Let me tell you, it's a fascinating world out there! From market trends to financial reports, there are a multitude of things that can impact your investment decisions. So, buckle up, and let's explore the exciting world of stock market trading together!

- Company news and performance: Investors look for companies with strong financial performance, including revenue growth, earnings growth, and free cash flow. They also consider companies with competitive advantages, such as strong brands, patents, or customer loyalty.

- Industry performance: Investors tend to favor industries that are growing and have strong fundamentals. They also avoid industries that are declining or facing significant challenges.

- Investor sentiment: Investor sentiment can have a big impact on stock prices. When investors are bullish, they are more likely to buy stocks, which can drive up prices. When investors are bearish, they are more likely to sell stocks, which can drive down prices.

- Economic factors: The overall health of the economy can also affect stock prices. When the economy is strong, investors are more likely to be bullish on stocks. When the economy is weak, investors are more likely to be bearish.

Tips for making buy and sell decisions in the stock market

- Buy stocks when they are undervalued. This means that the stock is trading below its intrinsic value, which is the value of the company's future cash flows. One way to determine if a stock is undervalued is to look at its price-to-earnings ratio (P/E ratio). A lower P/E ratio typically indicates that a stock is undervalued.

- Sell stocks when they are overvalued. This means that the stock is trading above its intrinsic value. One way to determine if a stock is overvalued is to look at its P/E ratio. A higher P/E ratio typically indicates that a stock is overvalued.

- Have a stop-loss order in place. A stop-loss order is an order to sell a stock if it falls below a certain price. This can help to limit your losses if the stock price declines significantly.

- Rebalance your portfolio regularly.This means selling stocks that have outperformed and buying stocks that have underperformed. This can help to reduce your risk and maintain your desired asset allocation.

It is important to note that there is no one-size-fits-all approach to making buy and sell decisions in the stock market. The best approach for you will depend on your own individual circumstances. It is also important to do your own research before making any investment decisions.

How much does reading books help us succeed in the stock market?

Reading books can be very helpful for investors who want to succeed in the stock market. Books can teach you about the basics of investing, as well as more advanced concepts such as technical analysis and fundamental analysis. They can also help you to develop your own investment philosophy and learn from the experiences of other investors.

Here are some of the benefits of reading books to succeed in the stock market:

- Gain knowledge about the stock market. Books can teach you about the different types of investments available, the risks and returns associated with each type of investment, and how to build a diversified portfolio.

- Learn from the experiences of others. Many books are written by successful investors who share their insights and strategies. Reading these books can help you to learn from their mistakes and avoid making the same mistakes yourself.

- Develop your own investment philosophy. Reading books can help you to develop your own investment philosophy, which is a set of principles that will guide your investment decisions.

Of course, reading books is not a guarantee of success in the stock market. However, it is a valuable tool that can help you to become a more informed and successful investor.

Here are some tips for choosing books to read about the stock market:

- Read books written by reputable authors. There are many books on the stock market written by people who are not experts. It is important to choose books written by authors who have a proven track record of success in the stock market.

- Read books that cover a variety of topics. There are books on the stock market that cover a wide range of topics, from basic investing concepts to advanced technical analysis techniques. It is important to read books that cover a variety of topics so that you can get a well-rounded understanding of the stock market.

- Don't be afraid to read challenging books. Some of the best books on the stock market are challenging to read. However, it is important to push yourself to read these books because they can teach you the most about the stock market.

Here are some recommended books on the stock market:

- The Intelligent Investor by Benjamin Graham. Read This

- One Up On Wall Street by Peter Lynch. Read This

- A Random Walk Down Wall Street by Burton G. Malkiel. Read This

- The Essays of Warren Buffett by Warren Buffett. Read This.

- The Little Book of Common Sense Investing by John C. Bogle. Read This.

Reading books is a great way to learn about the stock market and improve your chances of success. By reading books, you can gain knowledge from the experiences of others, develop your own investment philosophy, and make more informed investment decisions.

Comments